Next, $560.4 million in selling and operating expenses and $293.7 million in general administrative expenses were subtracted. This left the company with an operating income of $765.2 million. To this, additional gains were added and losses subtracted, including $257.6 million in income tax. If you prepare the income statement for your entire organization, this should include revenue from all lines of business. If you prepare the income statement for a particular business line or segment, you should limit revenue to products or services that fall under that umbrella. After identifying your reporting period, calculate your business’s total revenue generated in that timeframe.

How does a common size income statement help in trend analysis?

After calculating income for the reporting period, determine interest and tax charges. Here’s an overview of the information found in an income statement, along with a step-by-step look at the process of preparing one for your organization. While common size analysis is a powerful tool, it has limitations. There should also be huge concern about the difference in the selling, general and administrative expenses. This Site cannot and does not contain legal, tax, personal financial planning, or investment advice. The legal, tax, personal financial planning, or investment information is provided for general informational and educational purposes only and is not a substitute for professional advice.

Common Size Financial Statement: Definition, Overview & Formula

- Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

- Like in the case of the net profit margin, a higher gross profit margin indicates a higher level of profitability.

- This is instead of a traditional financial statement that would list items as absolute numerical figures.

- Let us take the example of Apple Inc. to understand the concept and see the trend in the financials of the last three years.

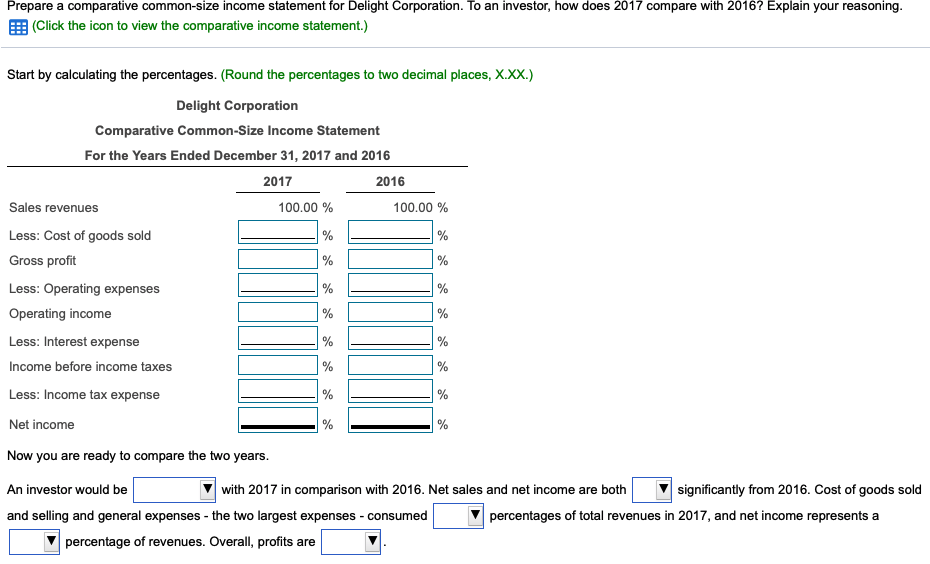

If you just looked at numbers, it might seem like this company did better in 2022 because sales increased from $500,000 to $600,000. However, net income only accounted for 10% of 2022 revenue, whereas net income accounted for more than a quarter of 2021 revenue. The company should look for ways to cut costs and increase sales in order to boost profitability. With a common size horizontal analysis, you can easily see if, for example, your expenses increased as a percentage of revenue, stayed the same or decreased among different time periods.

What is a common-size financial statement?

This type of financial statement makes it simpler for analysts to evaluate the profitability of a company over time. It also shows the impact of each line item on the overall revenue, cash flow or asset figures for your company. One version of the common size cash flow statement expresses all line items as a percentage of total cash flow. The common-size balance sheet functions much like the common-size income statement. Each line item on the balance sheet is restated as a percentage of total assets.

Why Is Common Size Analysis Important?

For example, if Company A has $1,000 in cash and $5,000 in total assets, this would be presented in a separate column as 20% in a common size balance sheet. Assets, liabilities and equity are presented as a percentage of total assets or total liabilities and equity. It helps understand the nature of a company’s asset structure and sources of capital. Common size financial statements compare the performance of a company over periods of time. The information can be compared to competitors to see how well it is performing. A financial statement or balance sheet that expresses itself as a percentage of the basic number of sales or assets is considered to be of a common size.

What Is the Purpose of a Common Size Balance Sheet?

Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills. Limitations include a lack of context on absolute values, riding a bicycle or e inability to reflect industry norms, and minimal insight into non-operational factors. These two methods enable a quick evaluation of operational efficiency, cost management, and overall financial stability.

Using common-size financial statements helps spot trends that a raw financial statement may not uncover. A common size balance sheet helps in evaluating a company’s asset structure, liabilities, and equity in relation to total assets, which simplifies comparison between companies of different sizes. Analysts also use vertical analysis of a single financial statement, such as an income statement.

This tool is especially important if you’re using key performance indicators to measure your business’s performance and profitability. The approach lets you compare your business to your competitors’ businesses, regardless of size differences. The most significant benefit of a common-size analysis is that it can let you identify large or drastic changes in a firm’s financials.

Common-size analysis, also known as vertical analysis, is the process of constructing a financial statement of a common size. The next column shows each item as a percentage of average assets. This brings up an important consideration in common-size balance sheets. Do you want them as of a single point in time or as an average of a range of time?